February 2025 Nickel & Surcharge Update

Monthly Nickel and Surcharge Update

February 2025 Update

Thanks for reading the Ram Alloys Monthly Nickel and 316L s/c update, intended to help our valued customers make educated business decisions.

PRESIDENT TRUMP - 25% TARIFF ON STEEL AND ALUMINUM

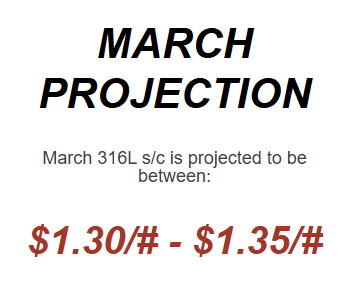

- As projected, February s/c decreased by $0.03

-

- March will likely rise back to January 2025 or Q4 numbers

- Indonesian Impact

-

- 56% of global Ni supply restricted with new quotas (see article)

- President Trump to announce new 25% tariffs on steel and aluminum (no details)

-

- Additional, reciprocal tariffs being announced this week (articles below)

- EU proactively reduced tariffs on USA autos from 10% to 2.5%

- This aligns with the current USA's 2.5% tariff on EU autos

Current Take

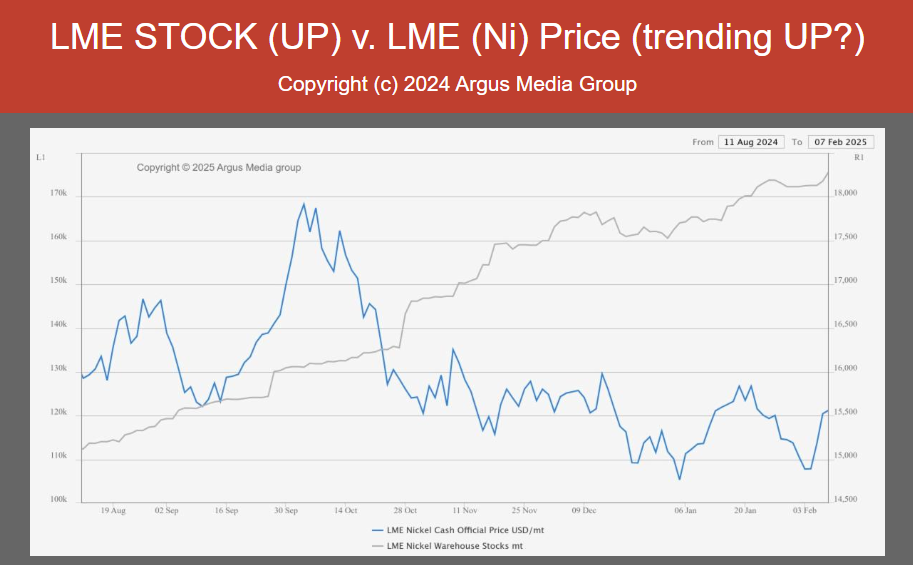

RAW MATERIAL PRICES: Nickel prices have stabilized, but could soon rebound due to the Indonesian government reducing Nickel export quotas in 2025 and 2026. This is why Ni prices have increased, even though Ni stock is also increasing.

Overall market sentiment believes inventories will draw down later this year, which unfortunately coincides with an anticipated rise in demand. The combination will likely result in lead time expansion and price increases.

New Tariffs will likely result in higher prices...sooner rather than later.

Natural gas prices in Europe surged recently (equivalent to oil at $100/bbl), destructive for energy-intensive manufacturing and likely resulting in a surcharge increase.

LEAD TIMES: No change - lead times reduced from 2023 to 2024, and while that may hold true for the first half of 2025, we expect mill lead times to extend Q42025 and into 2026.

BASE PRICES: Recent increases have remained firm, new Tariff future impact TBD.

SECTION 232: It didn't take long to return to the land of uncertainty. Will we see an Executive Order this week? Will that actually define anything? Will there an an extension like the Canadian and Mexican tariffs? Too many unanswerable questions.

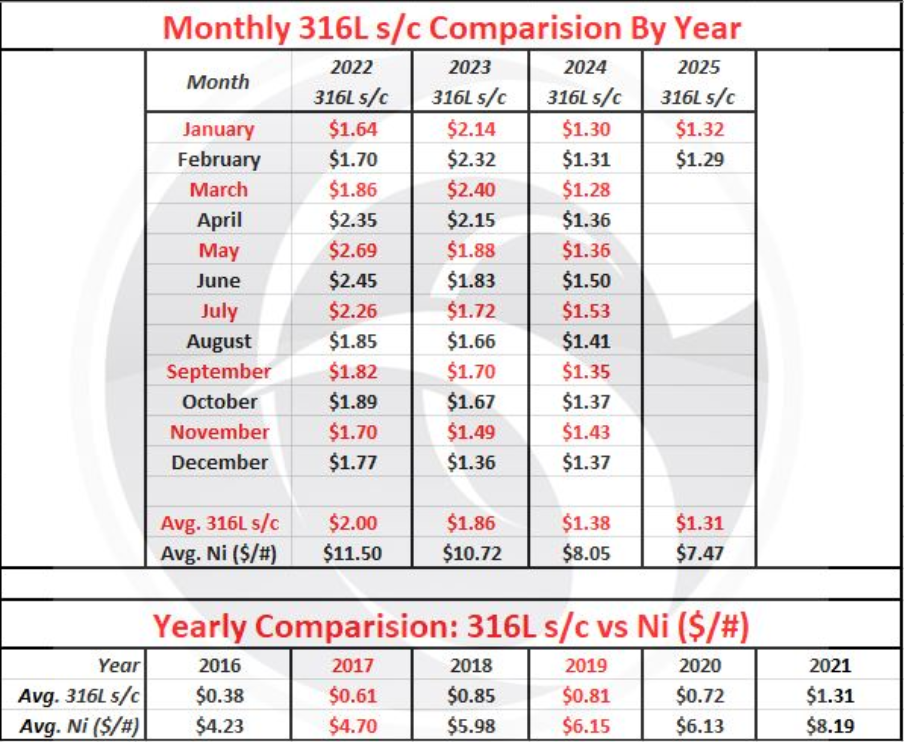

Yearly/Monthly 316L s/c and Ni Charts

Industry News

Click the links to read the articles below:

- Trump announcing 25% tariff on steel and aluminum

- Trump to announce reciprocal tariffs this week (article 1)

- Trump to announce reciprocal tariffs this week (article 2)

- EU unilaterally reduces USA auto quotas from 10% to 2.5%

- Nickel prices jump on Indonesian quotas, Asia raises stainless prices

- Global Nickel prices uncertain, as Indonesia cuts output

- Canada and Mexico "not doing enough" in response to Tariffs according to President Trump

- EU natural gas prices reach new highs

EU Quota Info

EU Quota System Highlights:

- Quotas by EU country, not mill, and by HTS Code, not grade

- Quarterly volumes based on a first come/first served bases

- Imported volumes > quota assessed a 25% tariff

- Exclusions apply, but adjustments under consideration

Ram Alloys is a niche service center supplying a complete inventory of stainless steel, nickel products, pump shaft quality bars, and boat shaft quality bars in a full range of standard grades. Value-added services include comprehensive and customized processing options, prompt shipping, same-day order turnaround, and 24/7 availability. We're here to ensure that your procurement needs are met quickly and accurately, minimizing schedule impacts and return material authorizations. Request a quote today!