October 2024 Nickel & Surcharge Update

Monthly Nickel and Surcharge Update

October 2024 Update

Thanks for reading the Ram Alloys Monthly Nickel and 316L s/c update, intended to help our valued customers make educated business decisions.

GEOPOLITICAL CHAOS --> EXPECTED PRICE INCREASES

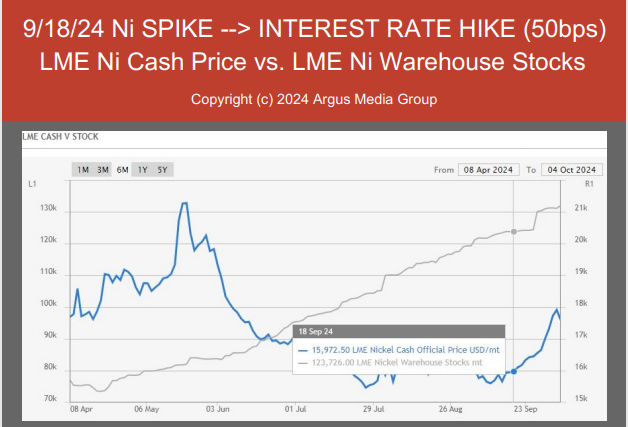

- 09/18 Interest rate decrease (50bps) --> increased demand speculation --> increased Ni prices

- Major Chinese economic stimulus --> increased demand speculation --> increased Ni prices

- Middle East conflict intensifies --> energy surcharge increase

- Premium grades are still in high demand in 2024

- Longshoreman Port Strike --> short-lived, but caused shipping delays and rate increases

Current Take

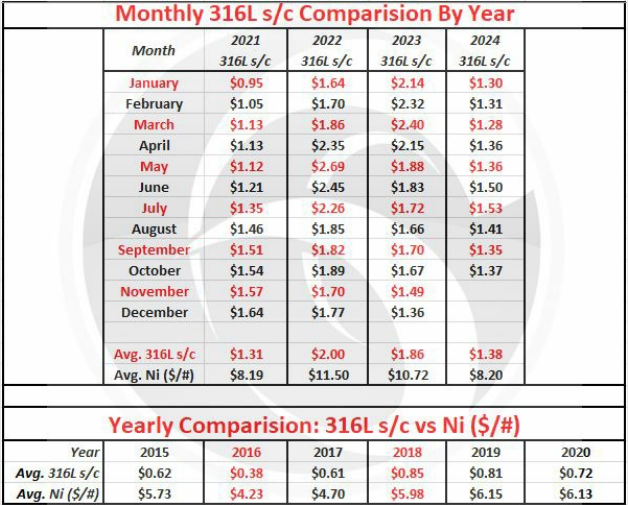

RAW MATERIAL PRICES: 2024 surcharges have been relatively stable. Inventories are higher than recent years, and demand is less than recent years. However, a Geopolitical storm is brewing - war + economic stimulus - that may result in price hikes. Time will tell if it's fake or has staying power. We feel like inventories need to decrease and demand must increase in order for prices to noticeably rise. However, our internal industry health metric appears to indicate 2025 price increases. Two to three more months' data is needed, so stay tuned. Interesting chart below: Ni spiked on 09/18, same day as interest rates dropped 50 bps. Monitor the EU's carbon border adjustment mechanism (CBAM) in 2025. Although CBAM takes effect in 2026, mills will likely start adjusting to higher priced refined Ni in 2025, as CBAM limits the use of cheap Nickel Pig Iron.

LEAD TIMES: Story remains the same - remelted grades (extended: 70-100 weeks), airmelted grades (normal 16-40 weeks). Lead times vary by country of origin, grade, and size.

BASE PRICES: Majority of mill held base pricing in September, while a few hiked. Some cited increased activity as a reason, others likely baked-in expected energy cost volatility. This may indicate a decrease in inventory levels (mills are smart).

SECTION 232: The TRQ system is scheduled to expire 12/31/2025; however, this can be altered by "Presidential Proclamation." Have fun predicting future actions.

Yearly/Monthly 316L s/c and Ni Charts

LME Ni Stock (up) vs LME Ni $/# (down)

Industry News

Click the links to read the articles below:

- LME futures: Base metals up on China hopes, US jobs

- Europe to keep using NPI until CBAM: Anglo American

- Chinese Chip Stocks Gain $13 Billion on Talk of Beijing Stimulus

- China's top econimic planner to hold briefing on Oct 8 as investors eye more stimulus

- Gold jumps to record high after US Fed delivers 50 bps rate cut

- Fed Chair Powell says the US economy is in "solid shape" with gradual rate cuts coming

EU Quota Info

EU Quota System Highlights:

- Quotas by EU country, not mill, and by HTS Code, not grade

- Quarterly volumes based on a first come/first served bases

- Link: US Customs and Border Protection Quota Bulletins

- Link: US Customs and Border Protection Quota Utilizations found in its Commodity Status Reports

- Imported volumes > quota assessed a 25% tariff

- Exclusions apply, but adjustments under consideration

Ram Alloys is a niche service center supplying a complete inventory of stainless steel, nickel products, pump shaft quality bars, and boat shaft quality bars in a full range of standard grades. Value-added services include comprehensive and customized processing options, prompt shipping, same-day order turnaround, and 24/7 availability. We're here to ensure that your procurement needs are met quickly and accurately, minimizing schedule impacts and return material authorizations. Request a quote today!